Tax planning is the arrangement of one's financial and business affairs in such a manner as to attract either locally or abroad the minimum tax, without the contravention of any law or without defrauding the revenue by not declaring profits or by other deceitful means. Cyprus holds an important position in international tax planning due to its favourable tax regime and its wide network of double tax treaties.

The main purpose of these treaties is the avoidance of double taxation of income earned in any of the two contracting States. Under these agreements either a credit is allowed in a contacting State in respect of tax levied by the other State on the same income or such income is exempt from tax. Thus, the taxpayer does not pay more than the higher of the two rates or is not taxed twice on the same income.

In order that a Cyprus company may be entitled to take advantages of a double tax treaty, it should be considered for the purposes of the treaty as resident in Cyprus. For the purpose of most treaties a Cyprus company may be deemed resident in Cyprus if the majority of its directors reside in Cyprus, board meetings take place in Cyprus and generally the decision making is in Cyprus. The place of residence of the shareholders of the company is in most cases immaterial but in case more ‘substance’ is required we can advice you on how to achieve this (e.g., by setting up a fully operational office in Cyprus on which we can also fully assist you).

With our international network of tax experts, you can be assured proper tax planning and also, we can help you materialise such plans with great care and utmost professionalism (e.g. advice you on treaties for the avoidance of double taxation etc).

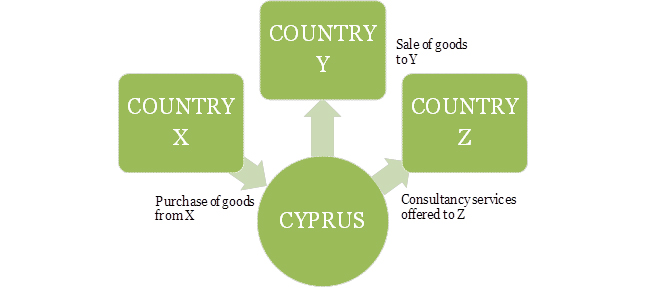

Here follows an illustration of how a Cyprus International Business Company (IBC) may be used for the purpose of providing goods and services to other countries as a result of which taxable profits may (provided there are valid reasons for doing so and not just tax reasons) be taxed in Cyprus at between 0% and 12.5%. For this to happen one must also be able to demonstrate “substance” and legitimate non tax- avoiding reasons for setting up and managing a Cyprus Company for sole trade or services or investments or other purposes to/from Cyprus and/or within Cyprus.

THE CYPRUS INTERNATIONAL COMPANIES SELLS GOODS/SERVICES TO COMPANIES IN OTHER COUNTRIES

THE PROFITS OF THE CYPRUS INTERNATIONAL COMPANY MAY BE DISTRIBUTED WITH ZERO WITHHOLDING TAX

By offering services/goods to companies in various countries via Cyprus the effect is that the taxable profits of this Cyprus company are taxed at 12,5% on its taxable profits (note some categories of income are not taxed in Cyprus e.g., buying/selling immovable property outside Cyprus.

It is noted that the above is just an example and one must always bear in mind the principles of “Arm's Length Transaction”, “Anti-Money Laundering Legislation” and all relevant local regulations that need to be complied with and which again we (in cooperation with law firms) can advice you on whatever needed.